owner draw vs retained earnings

So if I understand correctly your contributiondrawing is negative. When they take a draw for their personal uses they use cash reserves.

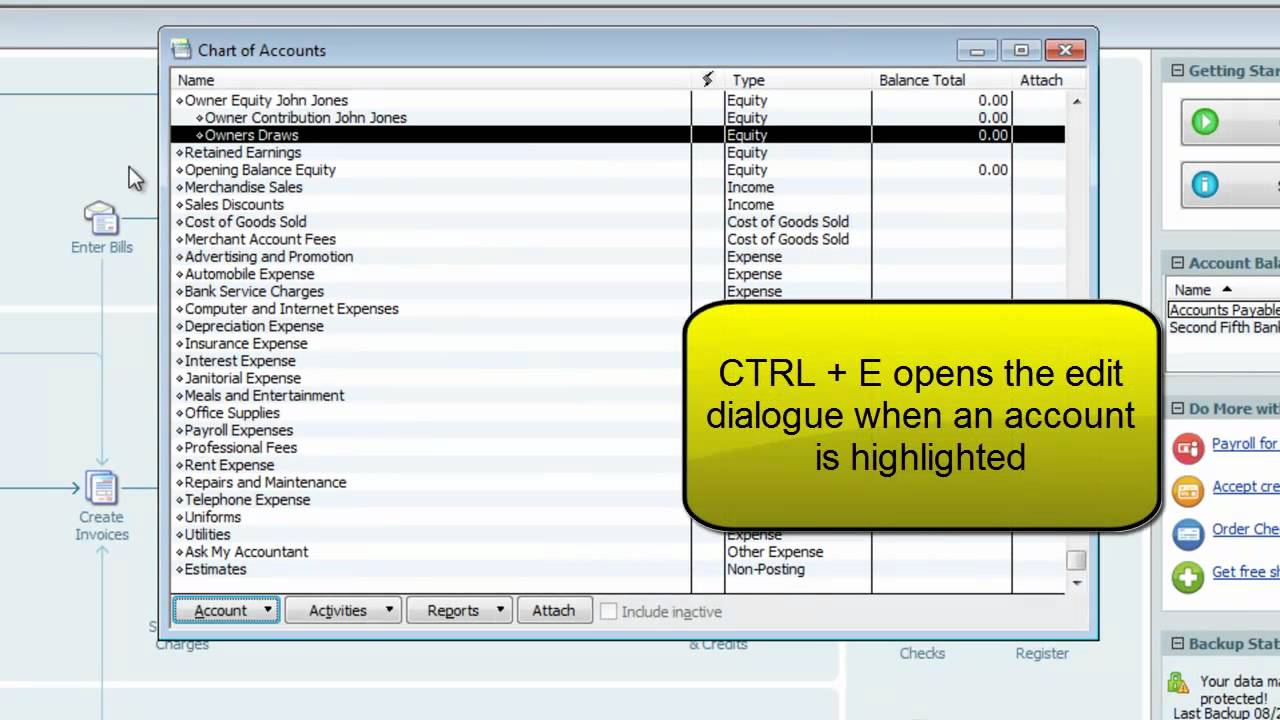

Quickbooks Owner Draws Contributions Chart Of Accounts Quickbooks Accounting

Owners draws are withdrawals of a sole proprietorships cash or other assets made by the owner for the owners personal use.

. If you have shareholders dividends paid is the amount that you pay them. What is an owners draw. Often directors and owners draw more funds than accumulated retained earnings hence the equity.

A sole proprietor does not keep a separate account for retained earnings since he doesnt pay dividends out to shareholders or partners. Heres a high-level look at the difference between a salary and an owners draw or simply a draw. Youre allowed to withdraw from your share of the businesss value through an owners draw.

It means owners can draw out of profits or retained earnings of a business. Businesses operate in one of three formssole proprietorships partnerships or corporations. Owners equity is made up of different funds including money youve invested into your business.

Although paid differently both. Owners equity is made up of different funds. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

A corporation pays tax on annual net income profits minus deductions credits etc not retained earn. Then top management will consider paying the dividend to the shareholders. The business would record such overcompensations as directors or owners loans.

This account should be closed out to retained earnings and not carry a balance. The accounts you are referring to are cumulative in Wave. Owners Draw Taxes.

Owners draws are usually taken from your owners equity account. Draws can happen at regular intervals or when needed. Retained earnings can also be accumulated losses of the business if the business has.

I like NOT to see Retained Earnings but name that one Owner Equity. Retained earnings are an integral part of equity. Rather than having a regular recurring income this allows you to have greater flexibility and adjust how much money you get depending on how.

As for Owner Equity open the chart of accounts and try to open each Equity account. Business owners can withdraw profits earned by the company. The owners dont pay taxes on the amounts they take out of their owners equity accounts.

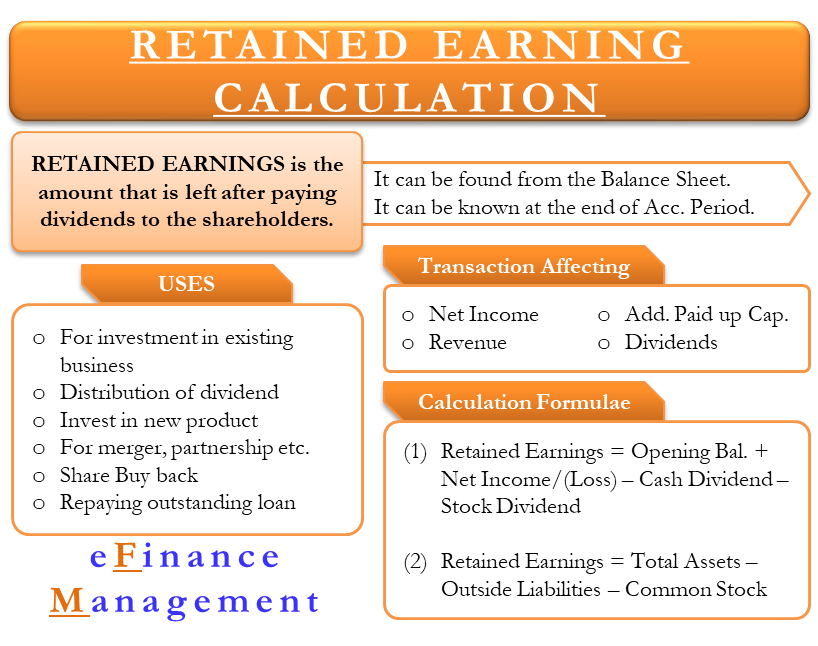

One of the main differences between paying yourself a salary and taking an owners draw is the tax implications. Retained earnings are a total of all the accumulated profits that a company has received and has not distributed or spent otherwise. Owners draws are usually taken from your owners equity account.

On the other hand retained earnings represents the accumulated profits and losses of the entity. The owners loan will be adjusted against dividends or distributions when available. It creates a negative drawings impact on the business.

With the draw method you can draw money from your business earning earnings as you see fit. Three Forms of Business Ownership. There are two main ways to pay yourself.

Any money you contribute to the business that you dont expect to be repaid should be booked to this account. Business owners might use a draw for compensation versus paying themselves a salary. Sole proprietors have owners equity.

The owners draw or distribution account is a contra-liability account that reduces equity. An owner of a sole proprietorship partnership LLC or S corporation may take an owners draw. The business owner takes funds out of the business for personal use.

All business types except corporations pay taxes on the net income from the business as calculated on their business tax return. However this draw should not exceed the available profit or reserves. The owner still must keep track of his expenses revenues and net income as well as the money he keeps in the business and uses for equipment transportation postage salaries and other expenses.

Owners Draws 50000 Total Closing Owners Equity. If you net the accounts together you should get partner capital. Say you open a company with your friend as equal partners each putting up 250000 in cash.

An owner of a C corporation may not. In other words retained earnings are accumulated earnings of a business after paying dividends or drawings to its stockholders or owners. You should also have an Owners Draws account in the equity section to record any cash you withdraw from the.

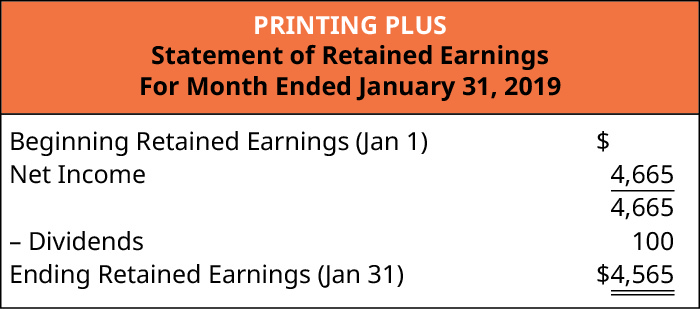

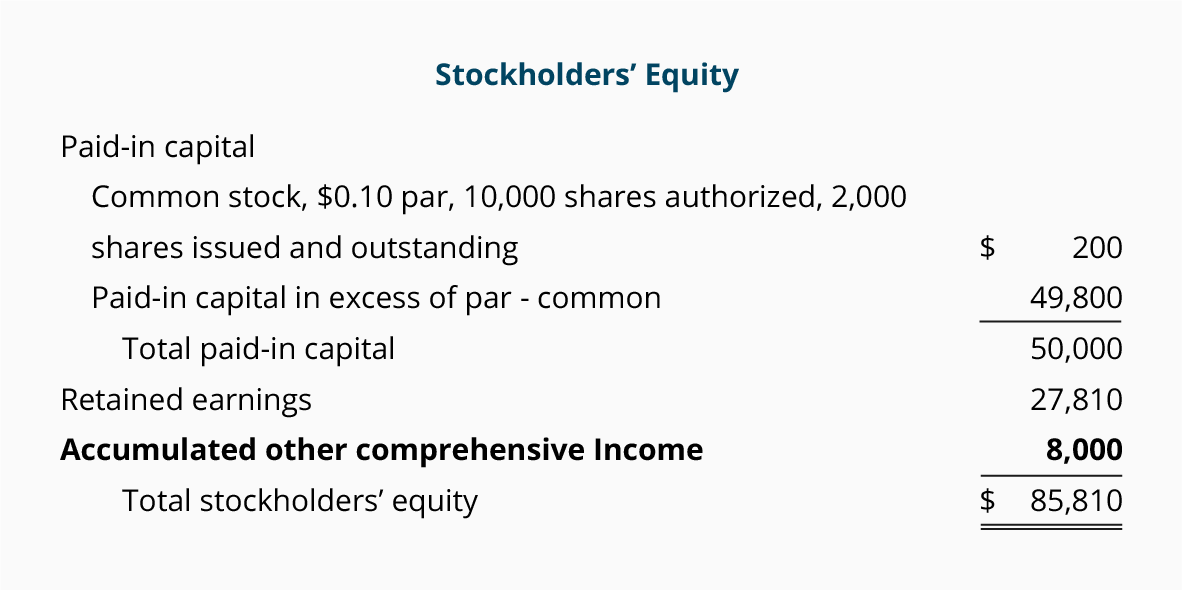

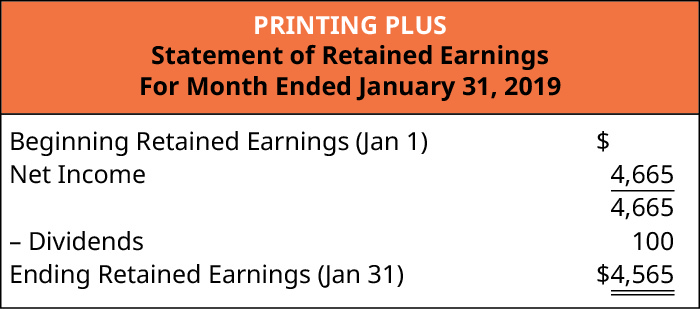

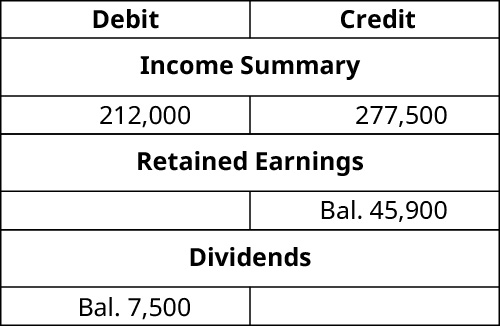

Retained earnings are calculated by starting with the previous accounting periods retained earnings balance adding the net income or loss and subtracting dividends paid to shareholders. The one that does NOT have a Register view no matter what it is named is Retained Earnings or Owner Equity that QB sill close the prior year into. Salary method vs.

The draw method and the salary method. Opening Balance Equity This account gets posted to when you create a new chart of account for a loan or item that you enter a opening balance for in the set up of the account in QuickBooks. Partnerships utilize a separate.

An owners draw is an amount of money an owner takes out of a business usually by writing a check. The information contained in this article is not tax or legal. A draw lowers the owners equity in the business.

Retained earnings are profits or earnings of the business that have been kept for business use and not distributed to the owners or stockholders. If you are generating profits which I assume you are in order to continue taking draws then your retained earnings would be positive. You cannot set up Subaccounts here.

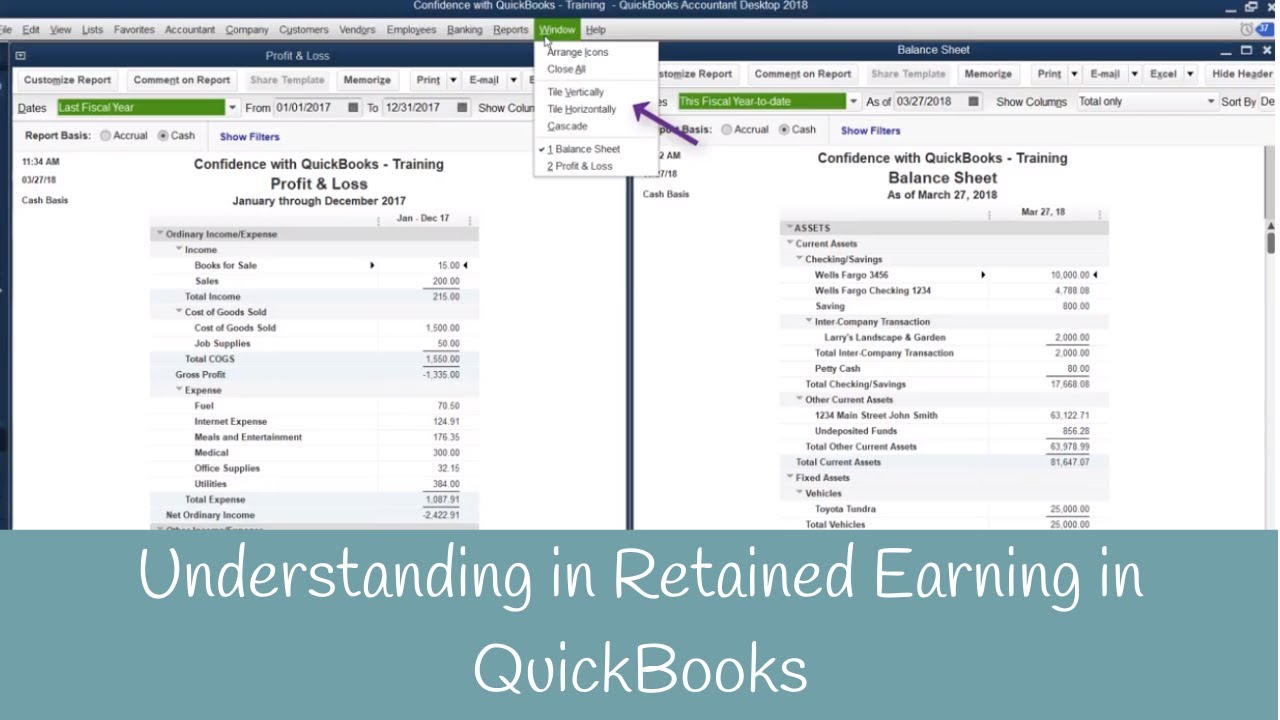

Owners draws can be scheduled at regular intervals or taken only when needed. The above picture is from data in QuickBooks Online. You want to create an account in your equity section called Owners Contributions.

Accumulated earnings of the organization for the reporting year is the final financial result of its activities fewer dividends paid. The account in which the draws are recorded is a contra owners capital account or contra owners equity account since its debit balance is contrary to the normal credit balance of the owners equity or capital account. Accumulated profits general reserves and other reserves etc.

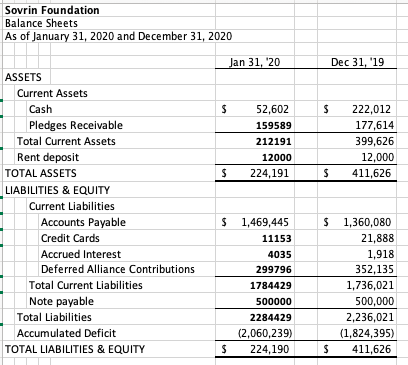

Sole proprietorships utilize a single account in owners equity in which the owners investments and net income of the company are accumulated and distributions to the owner are withdrawn. An owners draw also called a draw is when a business owner takes funds out of their business for personal use. In the table above retained earnings shows as a negative.

The business owner determines a set wage or amount of money for themselves and then cuts a.

/EAE-e75afd7778c6484da673c69f0fdfbb55.png)

Expanded Accounting Equation Definition

Statement Of Retained Earnings Definition Formula Example Video Lesson Transcript Study Com

Understanding Retained Earnings In Quickbooks Youtube

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

How To Calculate Retained Earnings Formula Example And More

Owners Equity Net Worth And Balance Sheet Book Value Explained

Negative Retained Earnings Accounting Services

Accumulated Other Comprehensive Income And Treasury Stock Accountingcoach

T Account For Retained Earnings Youtube

Negative Retained Earnings Accounting Services

Retained Earnings Account Is Missing

:max_bytes(150000):strip_icc()/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

Statement Of Retained Earnings Definition Formula Example Video Lesson Transcript Study Com

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Things That Affect Retained Earnings Youtube

Retained Earnings Account Is Missing

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

Debit And Credit Chart Accounting And Finance Accounting Career Accounting